Expert Insight: The Benefits of Debt Consolidation for Connecticut Residents

Understanding Debt Consolidation

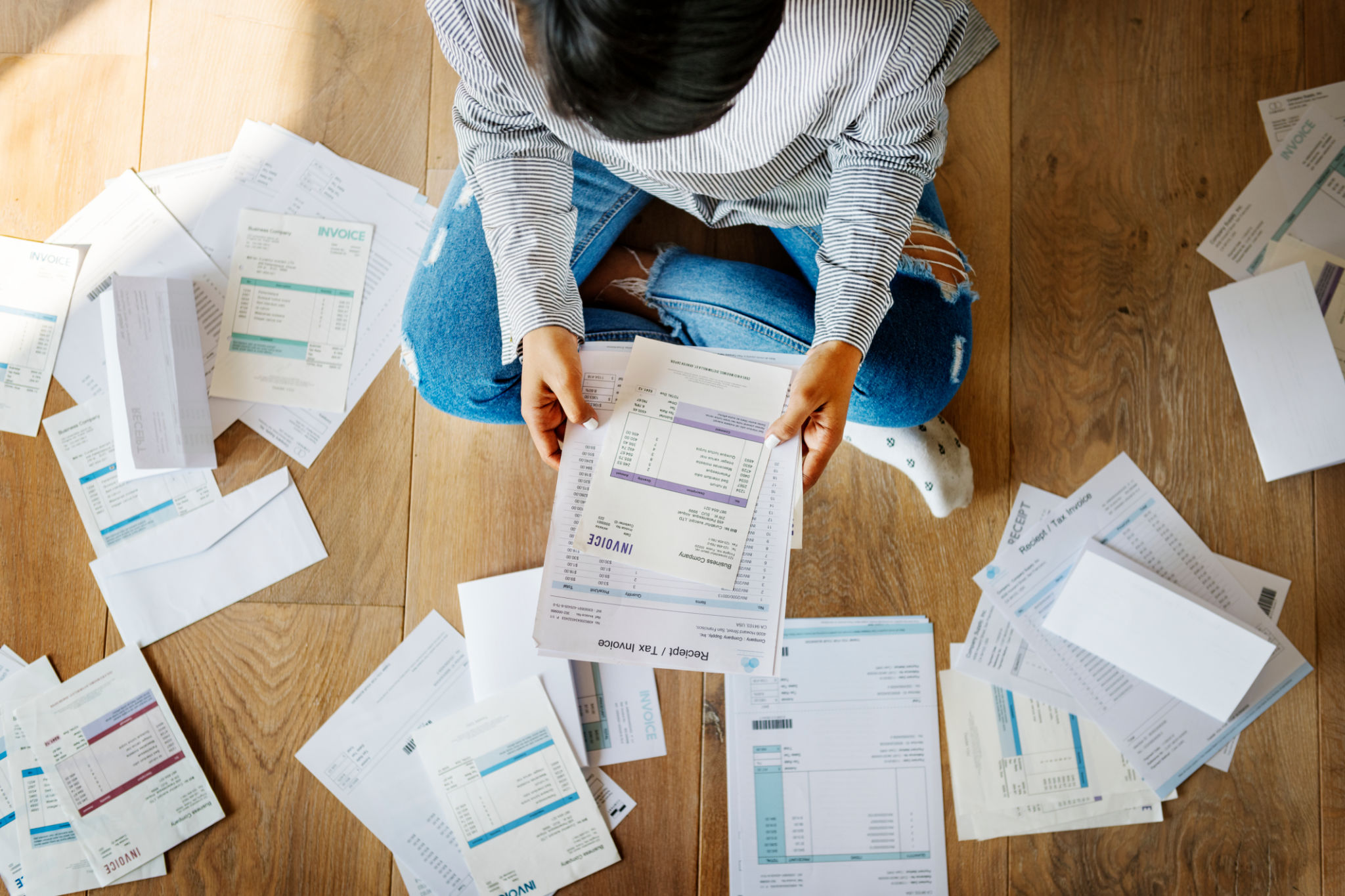

Debt consolidation is a financial strategy that can simplify the repayment process for many Connecticut residents. By combining multiple debts into a single loan, individuals can manage their payments more efficiently, often with a lower interest rate. This approach is especially beneficial for those juggling various credit card debts, personal loans, and other financial obligations.

Advantages of Debt Consolidation

One of the primary benefits of debt consolidation is the potential reduction in monthly payments. By securing a loan with a lower interest rate, borrowers can decrease the total amount of interest paid over time. This can lead to significant savings and faster debt elimination.

Another advantage is the simplification of finances. Managing multiple payments each month can be overwhelming, but consolidation turns these into a single monthly payment. This not only reduces stress but also decreases the likelihood of missing a payment and incurring penalties.

Is Debt Consolidation Right for You?

While debt consolidation offers many benefits, it’s crucial to assess whether it’s the right solution for you. Consider your current financial situation and the types of debt you hold. Consolidation may be particularly advantageous for those with high-interest debts such as credit cards.

Moreover, understanding your credit score is essential. A higher credit score can help you secure better loan terms, making consolidation more beneficial. Before proceeding, consult with a financial advisor to determine the best course of action based on your specific circumstances.

The Process of Debt Consolidation

The process begins with evaluating your debts and selecting a consolidation method that suits your needs. Options include taking out a personal loan, opening a balance transfer credit card, or utilizing a home equity loan. Each method has its pros and cons, so careful consideration is vital.

Once you've chosen the appropriate method, the next step is to apply for the loan or credit line. Upon approval, use the funds to pay off your existing debts. Then, focus on making consistent payments towards your new consolidated loan.

Local Resources for Connecticut Residents

Connecticut residents have access to several local resources that offer assistance with debt consolidation. Credit counseling agencies and nonprofit organizations can provide guidance and support throughout the process. These resources are invaluable in helping individuals navigate the complexities of debt management.

Additionally, many banks and credit unions in Connecticut offer specialized consolidation loans tailored to meet the needs of local residents. Exploring these options can lead to finding a solution that best fits your financial situation and helps pave the way to becoming debt-free.